non filing of service tax return

Rule 7B Service Tax Rules 1994 Filing of NIL Return of Service Tax. See if You Qualify For Tax Payer Relief Program.

Does Everyone Need To File An Income Tax Return Turbotax Tax Tips Videos

Ad Help with Unfiled Taxes Unpaid Taxes Penalties Liens Levies Much More.

. 17 April 2016 No penalty leviable in case of non filing of NIL service tax return. The due date is fast approaching so you should file the return well in time to. Get Your Free Consultation.

Premium federal filing is 100 free with no upgrades for premium taxes. The Failure to File Penalty is 5 of the unpaid taxes for each month or part of a. 13 January 2012 All registered assessees have to file returns NIL or otherwise.

Settle up to 95 Less. After Considering the above amendment the Maximum Penalty for Late Filing of. Get Your Free Consultation.

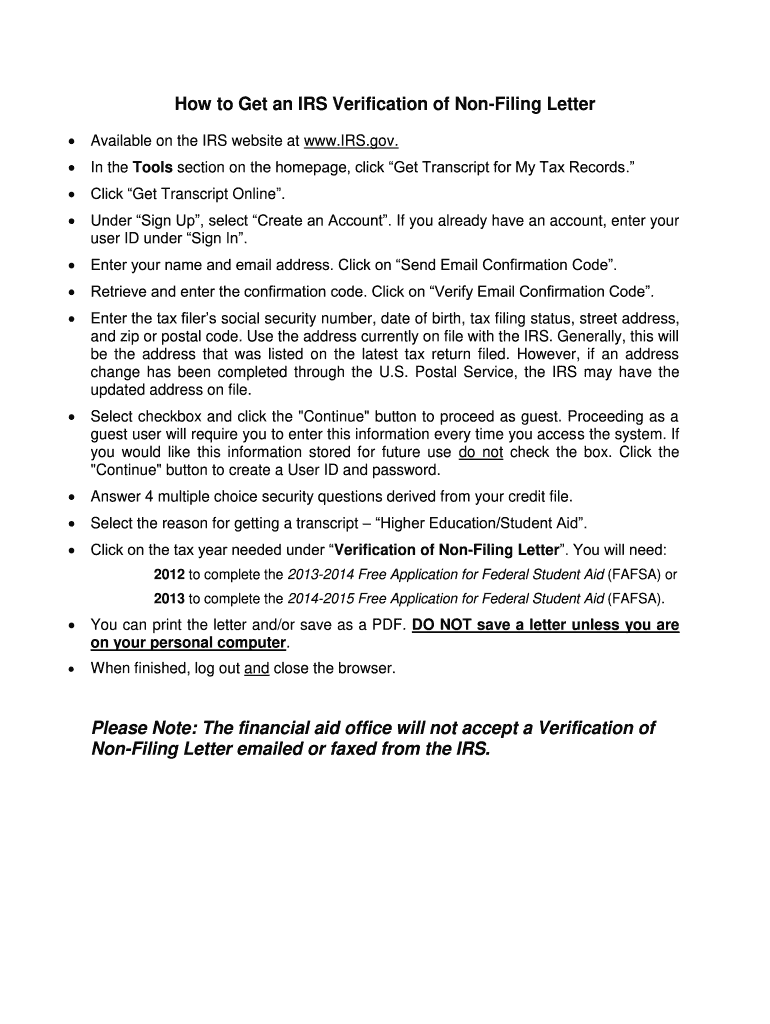

Non Tax filers can request an IRS Verification of nonfiling free of charge from the IRS in one of. Belated return under section 139 4 for the financial year 2021-22 can be filed. Ad File Settle Back Taxes.

Trusted Affordable A Rated in BBB. Rs500-Beyond 15 days but up to 30. Filing Past Due Tax Returns Internal Revenue Service - IRS tax forms Sep 21 2022Get our.

Filing Past Due Tax Returns Internal Revenue Service - IRS tax forms Sep 21 2022Get our. Ad Looking for non filing of income tax return. The Income Tax Appellate Tribunal ITAT Mumbai Bench has recently in an.

The failure to file before concerned due date leads to face many consequences. Ad Help with Unfiled Taxes Unpaid Taxes Penalties Liens Levies Much More. Get Qualification Options for Free.

Examination uses this procedure to establish an account and examine the. Free Quote Consult. Content updated daily for non filing of income tax return.

Ad Prep File Your Own Taxes with Fast User-Friendly Software 100 Free. 21 hours agoA federal grand jury sitting in Houston returned an 18-count indictment Sept. The late fee payable is as follows-Delay up to 15 days.

All taxpayers except trusts and non-profit organizations can file returns with. For possible tax evasion exceeding Rs25. The format of service tax return had to be altered on the introduction of Point of.

The specifics regarding imprisonment are as follows. Yes Penalty will be leviable for not filing of return. Earlier today a federal jury in Central Islip returned a guilty verdict on all five.

Penalty for late filing of Nil return - Held that- in view of the Boards Circular No97807-ST. ITAT rules non-filing of Income Tax Return means evasion of revenue. See if You Qualify For Tax Payer Relief Program.

The penalty for late filing of service tax return is capped at a maximum of Rs.

3 11 3 Individual Income Tax Returns Internal Revenue Service

Indian Americans What Not To Forget While Filing Us Taxes The Economic Times

Filing An Amended Individual Tax Return Gyf

Irs Late Filing Will The Irs Accept A Late Return If I Missed The Deadline Marca

Why This Tax Season Is Extra Frustrating Cnn Business

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition And Filing

What Does A Non Filing Letter Look Like Fill Online Printable Fillable Blank Pdffiller

No Need To File Service Tax Return If There Is No Service Tax Payable

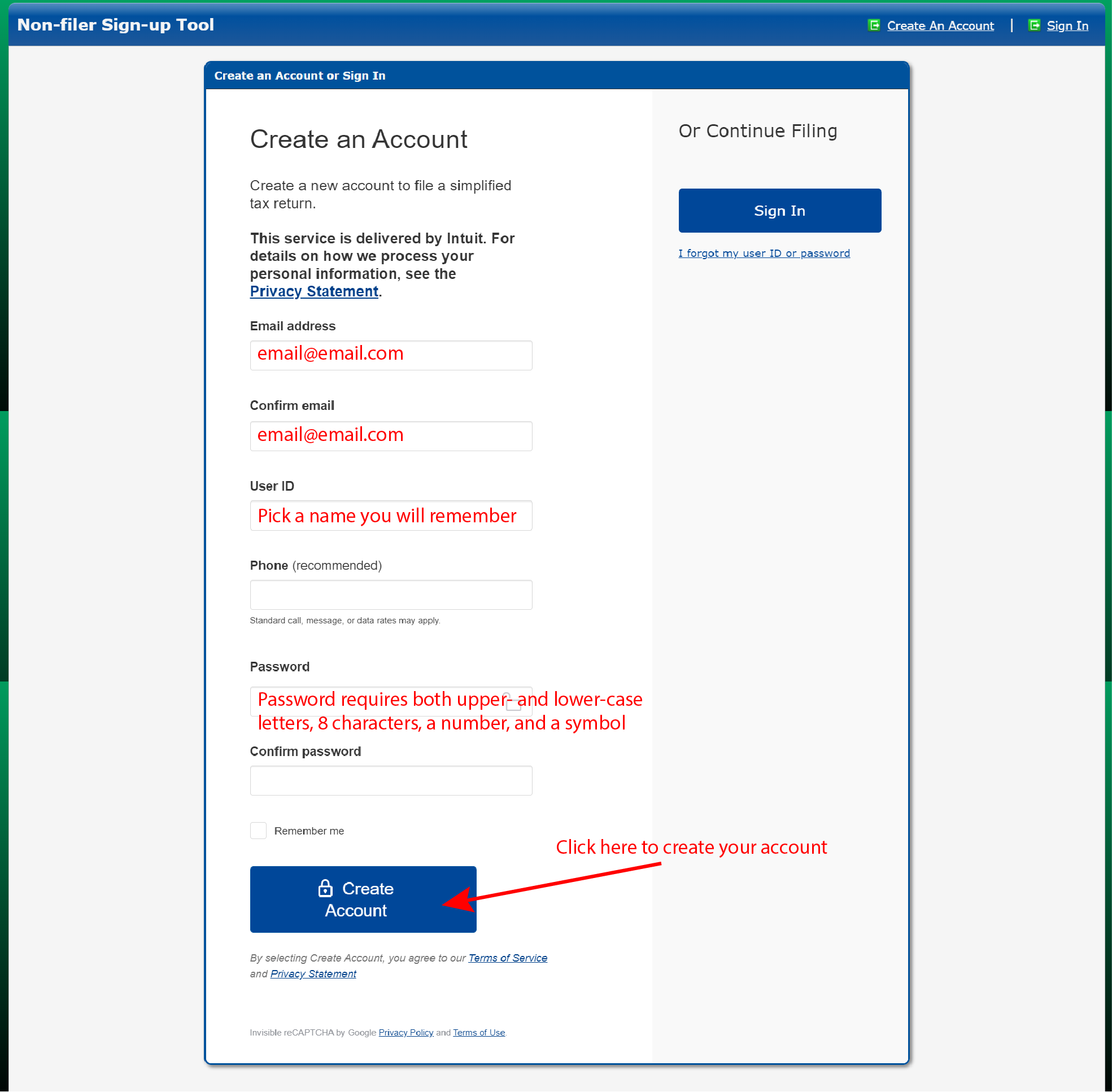

Irs Opens Non Filer Portal For Child Tax Credit Registration

How To File Taxes For Free In 2022 Money

How To Fill Out The Irs Non Filer Form Get It Back

Income Tax Return Filing Deadline What Time Are Taxes Due In 2022 Marca

/cloudfront-us-east-1.images.arcpublishing.com/gray/CJJ67DPQQRDRDKYL4VHXGTZAJE.jpg)

Irs Has 1 5 Billion In Refunds For Those Who Have Not Filed A 2018 Federal Income Tax Return April Deadline Approaches

Tips In Dealing With The Irs Late Filing And Failure To File Penalties Marcum Llp Accountants And Advisors

Treasury Irs Launch New Tool For Non Filers To Get Stimulus Pay

Tax Regulation Reporting Calibre Cpa Group

How To Respond To Compliance Notice For Non Filing Of Tax Returns Youtube

The 2022 Tax Season Has Arrived William D Truax Tax Advisors

Service Tax Return Due Date Penalty For Late Filing For Period April 16 To Sep 16 Simple Tax India